Trevor Stirling’s grounds for optimism

In a review of Western European Beverage consumption trends entitled The Long View: W European Alcohol Trends – hints of optimism emerge from the gloom Trevor Stirling, Financial Analyst for the European Beverages Market with stockbroker Bernstein, points out that altogether, Western Europe contributes around one quarter of the profits for the spirit majors Pernod Ricard and Diageo (nearer 30%) as well as the beer majors such as Heineken and some 50% for Carlsberg.

The former Strategy Director at Guinness Ireland in the late 90s covers the major European brewing and spirits companies, so when he points out that, “Downward trends in per capita alcohol consumption have slowed in every major country except Germany and in the last year have even turned to growth in Italy, Spain and the UK,” one must wonder if there might indeed be grounds for optimism – and one must also wonder how much can he tell us about how things look in the beverage market closer to home?

The good news is that that European optimism does seem to spill over into the Irish market according to Trevor’s findings.

“The same way as in Europe the world looks a bit better now than it did five years ago and certainly did 10 years ago,” he says, “Ireland went through a rough time in the recession.

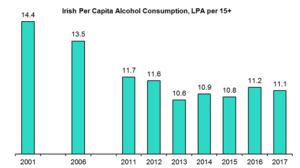

“As per DCU Economist Tony Foley’s statistics, alcohol consumption here on a per capita basis has dropped down 23% from its peak so we’ve seen a massive fall in consumption partly due to social patterns and the economy.

“15 years ago Ireland had one of the highest per capita ethanol consumptions in Europe; now it is broadly in-line with countries such as France, Germany and the UK.

“Per capita consumption has been around 11 Litres Per Adult for the last four years, slightly up in 2016 and slightly down in 2017, so broadly stable.”

If one overlays that on Ireland’s strong population growth one can see that the market is up year-on-year fairly consistently over the last four years, he says.

Product demand changing

The second significant dynamic affecting Ireland’s alcohol consumption market is the change in what people are drinking.

“In many Northern European countries beer as a percentage of the alcohol market as a whole has fallen,” he says, “In 2001 beer had 55% of the alcohol market here but this dropped to just 45% in 2017.”

Reflecting this fall have been the noticeable long-term gains for wine (which went from 14% in 2001 to 28% today) and more recently spirits (which went from 18.5% of the total alcohol market in 2010 to 19.8% today).

“However near-term things look differently,” he explains.

“Wine stood at 27.6% of alcohol consumption in Ireland in 2016 and 27.7% in 2017, so wine seems to be plateauing as a percentage of the total alcohol market. It’s too early to say if this is a ‘one-off’ but we also see that wine is starting to plateau in the UK as well.”

Spirits demand growing

Within spirits, as in the UK, we’re seeing a trend of demand for traditional spirits drifting towards demand for modern spirits.

“My father’s generation drank Cream of the Barley or other brands of blended Scotch which have now largely disappeared but we continue to see growth in demand for vodka, rum, gin and Bourbon.”

But with young women drinking more alcohol than in prior generations they‘re much more likely to drink spirts than beer. We also see that young men today tend to have broader palates, he observes.

“Men, when going to a nightclub tend to go for spirits and a mixer while with a meal they’ll have wine or a straightforward beer when watching the game with their mates in the pub.”

Trevor’s team has also looked at the on-trade consumption versus that in the off-trade to find a 20-year trend of people drinking less in the pubs in favour of drinking at home.

“For instance over 80% of beer was sold in pubs and bars in 2003 but today that’s under 65%,” he says, “However there’s some evidence that in the last couple of years that trend may be slowing and possibly even reversing. Perhaps this is due to the economic recovery tempting customers back out to pubs and bars and maybe the on-trade VAT reduction had helped.”

Competitive dynamics

Within the alcohol consumption categories themselves, the high level of demand has seen some pretty competitive dynamics taking place.

“In cider, for example, it’s clear that Heineken’s Orchard Thieves brand has been taking share from Bulmers who’ve certainly found life a lot tougher in the last three or four years.

“The biggest recent twist in the spirits markets has been the rise of gin. In the last five years gin volumes have grown at 13% per annum and have gone from just under 6% of the total spirits market to over 10%, with most of this growth coming at the expense of vodka and rum.

“Gordon’s gin has been the big winner as well as Bombay and Hendrick’s.

“Then there’s been the craft beer explosion, similar to the US and the UK, with approximately 70 breweries in full production, accounting for approximately 5% of the beer market. But it appears that it’s the more niche mainstream brands that have been squeezed. Diageo has gained 1.7 percentage points of share in the last five years, partly due to Hop House 13 lager and Heineken’s share has been broadly stable.

“Furthermore we’re starting to see a limit to how big craft beer can grow. In the US a few years ago craft beer was growing at well over 10% per annum. But today, it has hit a volume share of 13% and growth has plateaued.”

Trevor can also explain the reasons behind the huge popularity of craft beer in the US as witnessed by market share compared to here or the UK by pointing out that once upon a time there were really only four big brands in the US and they all tended to taste the same.

“The craft beer market in a UK context is somewhat different from that in the US,” he says, “In the UK, one has ale and quite a number of regional brewers so there’s not the same scope for craft.

“Ireland lies somewhere in between the two countries.

“Ireland had four big lager brands in terms of Harp, Budweiser, Heineken and Carlsberg, but there was always Guinness and to a lesser extent Smithwick’s for those drinkers who preferred a fuller flavour.

“We have also seen Guinness introduce Hop House 13 in response to demand for a craft offering which has proven pretty successful.”

But what’s clear is that the new Alcohol Bill just passed in the Dáil is likely to alter the market dynamics somewhat still.

What that alteration in market dynamics will turn out like has yet to be determined.

“We’ll just have to wait and see how that plays out,” he says.